Whether you’re running a startup, scaling fast, or facing financial complexity, the question eventually comes up: Is it time to hire a CFO? This guide breaks down when to bring in a full-time, fractional, or interim CFO — and how to know which one is right for your company’s stage.

In today’s fast-moving, tech-driven business environment, the role of the CIO is more critical — and more complex — than ever. Whether your organization is navigating digital transformation, merger integration, or large-scale ERP system upgrades, an Interim Chief Information Officer (CIO) can deliver immediate, strategic value without adding long-term overhead.

(Learn more about our Interim CIO Services and Fractional CIO Services here.)

Unlike consultants or rising IT managers, a seasoned interim CIO brings deep operational and leadership experience. These executives are not only capable of taking on the same responsibilities as a permanent CIO, but they also offer a focused lens on change, transformation, and rapid results.

Here are 5 common use cases where an interim CIO can be a powerful asset to tackle high-impact technology initiatives, IT leadership gap coverage, or specialized project execution:

When a national deli meat manufacturer faced declining yields, equipment inconsistencies, and looming leadership turnover, they called in a seasoned interim COO from InterimExecs’ RED Team to get operations back on track.

Michael Bartikoski, a veteran operations executive with deep roots in food manufacturing, stepped into the role with three goals: stabilize operations, improve yields, and build the next generation of leadership.

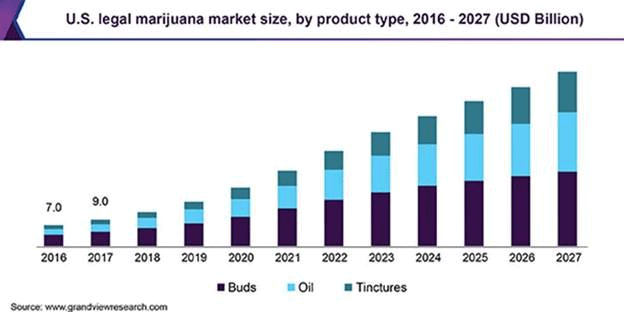

The global market for legal marijuana is valued at $17.7 billion as of 2019, and Grand View Research says that number is expected to rise to $73.6 billion by 2027. A quickly evolving market, more interim and project-based executives are being called on to lead the charge.

Jon Paul started his career at Arthur Anderson in the seventies then moved to multiple Chief Financial Officer positions, before getting on the cannabis bus in 2018 when he was recruited to take San Francisco-based gummies company, Plus Products, public.

Cannabis industry newsletter Grown In interviewed Jon Paul about the challenges involved in taking a company to a listing on the Canadian Stock Exchange.

There are marketing challenges, and then there is the challenge of marketing a product no one wants to admit they use, much less talk about it in public.

Enter Whitney Vosburgh. He’s an expert, interim Chief Marketing Officer who believes that building community can be a successful marketing strategy.

It worked for ConvaTec, a company that makes something no one ever wants to buy (but many people have to): colostomy and ostomy pouches. Those are the bags used by people who have a bowel blockage, which means they must eliminate bodily waste outside their body. It’s collected in pouches like the ones made by ConvaTec.

Not surprisingly, this is not something people want to chat about with strangers. But, Vosburgh hypothesized, putting them in a room with others facing the same challenges could make all the difference.

Native American economic development is critical for tribes seeking to effect a positive long-term impact on their communities. Federal 8(a) programs have been a great resource for Native American owned business, but tribal communities have evolved with an increasing focus on sustainable strategic economic development.

Tribal nations not only focus on the importance of cultural preservation and protected lands, but aspire to overcome big challenges facing their communities. From poverty to limited access to high-quality education, minimal healthcare resources, and inadequate workforce development, tribes work to solve these problems through economic growth. Tribes that thrive economically can better support funding for education, housing, and a multitude of crucial basic services.

Some tribal nations have excelled in the face of these challenges. Tribal economies have had a profound economic impact by growing Native American enterprises, increasing revenue, and acquiring operating companies. Prosperous tribes have also developed strong internal and external business partnerships.

There’s no question that the number of family offices is on the rise. A recent study by Campden Research revealed that there are over 5,300 family offices worldwide. About 2,200 of the family offices are in North America. About 67% of family offices that exist today were established after 2000.

There aren’t hard and fast rules on what a modern-day family office looks like. A single family office typically has over $150 million in private wealth and is one family. In recent years, multi-family offices have increased. In multi-family offices, families — related or not — have shared interests, investment goals, infrastructure needs, or operational requirements. By coming together, they save resources. This way family offices can focus more energy on portfolio growth and increasing net profit margins.

Over the past decade, the way family offices invest has evolved. In the past, family offices stayed in their comfort zone, by acquiring operating businesses in their business sector.

It’s not uncommon for private equity portfolio companies to double or even triple growth thanks to merger or acquisition. Albeit positive, rapid growth brings new operational challenges that can stop the upward momentum in its tracks. Interim executives bring the expertise needed to enable growth on a massive scale.

“Sometimes a business will start with $40 million in sales, and through acquisition will be two or three times that size. Often that creates an environment where you need to add to the management team, whether that be the CFO or the CEO,” said Forest Wester, a Partner at Trivest Partners that leverages interim executives to enable growth.

Private equity funds use interim executives in a variety of scenarios. However, these scenarios are typically problems that need to be solved such as the abrupt departure of a CEO.

We were having a conversation with an executive recently who shared about their experience parachuting into a business that was struggling with operational inefficiencies.

This executive, like many interims, kicked off the assignment by meeting face-to-face with the management team and employees to learn how the business functions, what’s working, and what isn’t. Their findings would turn into an operational roadmap of the business, where they would set out and implement a go-forward plan. When meeting with one team member and learning about what they did, the executive pointed to a process they had in place asking “why do you do that?”

The answer: “Because we’ve always done it that way”

(Alarm bells begin to loudly ring)

Interim management has arrived, and it only took 50 years, from a specialty that started in the Netherlands and moved slowly around the world. And its first and best incarnation is the interim CFO.

A good Chief Financial Officer will help a business catapult to the next stage of growth. Whether public, private or private equity backed, a CFO leads and implements strategy that ultimately creates value for shareholders, increasing EBITDA and cash flow. The means to get there may look different for each organization, but companies choose to bring in an Interim CFO because they are looking for transformation. And with record-high CFO resignations, the specialty continues to rapidly grow.

Operational Improvement and Strategic Planning

An Interim CFO will streamline accounting and financial reporting, helping owners, board members, investors and the management team get a clear look into the state of the business.