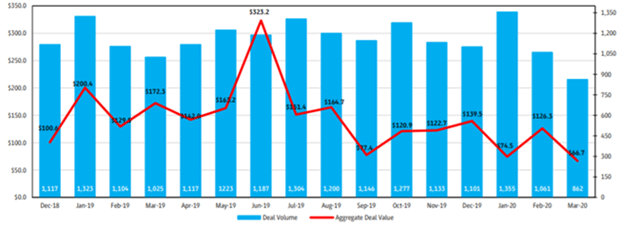

The COVID-19 pandemic and global economic lockdown has seen merger and acquisition (M&A) activity plummet. From $3.9 trillion in global takeovers in 2019, announced deals plunged 51% in the first quarter in the US according to Refinitiv. Uncertainties in the business and capital markets have led to buyers delaying or cutting back on their acquisition plans. But with crisis comes opportunity. Those able to navigate the new risk landscape may find compelling deals on the other side of the pandemic. Now more than ever, expert help with strategic planning, modelling out “what if” scenarios when the world frees up from lockdown, and preparing better for post-acquisition merger integration can help owners succeed in acquiring or being acquired.

M&A Trends Include Slowdown in Deals

As the coronavirus has spread across the world, there has been a corresponding M&A pullback. Mergers and acquisitions are already notorious for high failure rates. Not only is there difficulty in matching buyer and seller, but experts in transactions acknowledge many deals fall apart in negotiations, more in diligence, some at closing, and even more post-merger where there is often a failure to integrate.

Corporate development expert, David Vande Casteele, a member of the InterimExecs RED Team, calls the pandemic a black swan event, unforeseeable and yet with huge impact. “My buddies in New York are lamenting that all of the M&A deals that were about to close are now on hold because nobody knows what’s going to happen next,” he said.

Many high-profile deals, including Xerox’s $34 billion offer for HP, have been taken off the table, while others have failed to materialize. Reuters reported in April that for the first time since 2004, no M&A deal worth more than $1 billion was announced. According to financial software company Dealogic, Q1 global M&A activity recorded a year on year decrease of 35.5% and the lowest Q1 volume since 2013. In the United States, Q1 M&A activity fell by more than 50% compared to 2019.

Uncertainties and cash crunches are forcing company owners to focus on existing assets, rather than acquisitions. While this is similar to what was seen during the 2007 – 2009 recession, the current situation presents new challenges, such as the difficulty of closing deals with people working from home and site visits curtailed. The 170 deals completed in the first three months of 2020 is the lowest number since 2014, says Willis Towers Watson.

Reasons for Owners to Be Optimistic

Some M&A deals are being postponed, but others in the pipeline are getting done despite current challenges. Major M&A deals in 2020 include Thermo Fisher Scientific’s acquisition of Qiagen, Microsoft’s acquisition of 5G software maker Affirmed Networks, Inc., insurance broker Aon’s takeover of Willis Tower Watson, and Salesforce buying Vlocity.

Whether the recovery is ‘U’ shaped, ‘V’ shaped, ‘L’ shaped, or ‘Y’ shaped, there’s general agreement that opportunities exist post-coronavirus. “A potential upside here is there’s going to be a huge consolidation of companies that will struggle to survive through this,” said Interim CEO and COO Bill Mince.

Due to a surge in the number of private equity funds and vast fundraising into the asset category, PE shops are sitting on a mountain of dry powder – uninvested funds ready to deploy. Days before the World Health Organization (WHO) declared the novel coronavirus a public health emergency of international concern, Fortune reported that firms were sitting on a record $1.5 trillion. The head of mergers at a major Wall Street firm told CNBC, “They have been waiting for this type of market dislocation.” At the end of 2019, Warren Buffet’s Berkshire Hathaway had $128 billion in cash reserves earmarked for acquisitions.

Corporate executives also signal a post-crisis recovery through M&A activity. More than half (56%) of 2,900 C-suite members surveyed by consultancy EY were planning an acquisition in the next 12 months as they look past the current crisis to secure long-term growth.

Industries disproportionately affected by the pandemic, including tourism, transportation, restaurants, and oil and gas, could experience upticks in M&A activity in 2020 as buyers identify bargains in these sectors. So could sectors that could see higher demand due to the pandemic, such as hygiene products, technology, and healthcare. A Bloomberg survey of bankers found that deals to secure and support supply chains could be among the first to emerge in whatever the new-normal economy looks like.

Many experts see the market snapping back in the near-to-medium term (ETA Q3 – Q4). Once investors are confident that the worst is over, the M&A market should start to move again. Even without a quick bounce back, firms will be presented with unique opportunities to acquire or be acquired—and should be ready to act.

“A long boom in financial markets has caused buyers to complain that so much money has been chasing too few deals, making attractively priced assets hard to find,” said Duncan Smithson of Willis Tower Watson. “For investors keeping their powder dry, now is when to look past short-term events and focus on the long-term value of companies. By doing so, plus going through the process of repricing risk and taking selective opportunities, and reviewing the target’s culture against their own, buyers will find genuine deal-making opportunities.”

M&A Advisory Services and Risk Mitigation

Buyers and sellers are going to have to adjust to a changed M&A landscape forced by the pandemic and global lockdown. Smart company owners can benefit from engaging an experienced outsourced M&A leader who can supervise the company’s master blueprint and oversee the deal from start to finish.

On the buy side, it is more important than ever to refine acquisition targets and perform due diligence to assess the effect of the coronavirus crisis on the seller’s business. For example, acquirers may have to undertake enhanced due diligence to uncover possible red flags concerning virus impact on the target’s operations, financials, workforce, and suppliers.

“Lack of a plan is probably the biggest reason I see for acquisitions going wrong,” said InterimExecs RED Team’s Bill Mince, who has led the diligence and integration teams for over twenty-five acquisitions. “That starts with asking, ‘Why am I doing this acquisition in the first place?”

The RED Team’s David Vande Casteele agreed that poor targeting leads to many failures and added that having an integration strategy is vitally important. “Between 70% and 90% of all acquisitions fail, and most of them fail because of the lack of post-merger integration thought and plan,” said David.

Companies on the sell side can utilize an interim executive like David to improve operations in pursuit of increasing their valuation – even before going to market. This is especially crucial at a time when valuations have decreased by as much as 20 – 30%. They can make the most of the sale process, however, by engaging an M&A executive on a project basis to evaluate potential acquirers.

No matter which side of the transaction you’re on, having a repeatable, proven process for a merger or accusation can be the difference between failure and success.

“Savvy, smart owners and management teams say, ‘I need a player that has done this before,” said David. “Because otherwise, you’re very likely to make a whole bunch of mistakes and spend a whole bunch of money and not actually get to the place where you want to be in as short a period of time as possible.”

Bill Mince compared taking on the M&A process without expert help to do-it-yourself home improvement. “Without some professional to come in and help you through it, it’s not that easy,” he said. “You bring in an architect and a contractor. You go to someone who’s done this before.”

InterimExecs RED Team is an elite group of CEOs, CFOs, COOs, and CIOs who help organizations through turnaround, growth (merger, acquisitions, ERP/CRM implementation, process improvement), or absence of leadership. Learn more about InterimExecs RED Team at www.interimexecs.com/red-team or call +1 (847) 849-2800.

More Resources:

*How to Sell Your Company for Maximum Value

*In M&A Deals, An Interim CIO Starts IT Systems Integration Planning Early

*Poor System Integration & Company Culture Misalignment Leads to M&A Failure