Crypotcurrency. NFTs. Bitcoin. Blockchain. They’re the hip new financial products and all the cool kids are talking about them. As many as 40 million have invested in them.

But what are cryptocurrencies and how will they affect the way you run your business in the future?

We talked to Stephen Meade, founder of TheBullsEyeGuy.com, who shared his expertise in a cryptocurrency 101 tutorial. In this beginner’s guide, he explains what cryptocurrencies are, explodes some myths about what they’re good for and helps you understand how you may use them to manage your business in the future.

Let’s dive in.

What is Cryptocurrency?

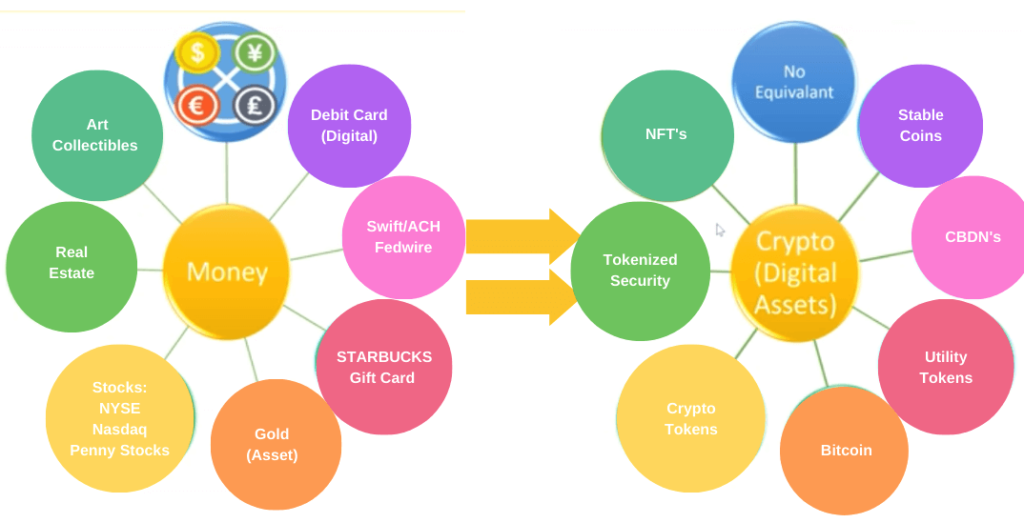

In short, cryptocurrencies are digital assets. They are NOT digital currency. There is no equivalent to the U.S. dollar, no actual paper money version of crypto.

Just as assets work differently — cash is liquid, real estate is not — each form of crypto works differently.

To better understand this, Meade compares the types of crypto to financial products we already know, use and love.

Stable Coins

Compare these to debit cards. Like debit cards, stable coins have only one use case because there is a network of people willing to accept them as payment. If no retailer accepted your debit card as payment, you could not access its value.

“I put $1,000 in the bank, I have $1,000 on my debit card. I put $1,000 in Tether, USDT or TRON, US TRX, I have $1,000 in Tether and that $1,000 has value to spend within the network of people that will accept the stable coin,” Meade says.

CDBN or CDBC

“These Central Digital Bank Notes or Central Digital Bank Currency equate to the Swift/ACH/FedWire banking systems that banks use to settle transactions. CDBN allow banks to manage their money transfers more efficiently,” he says.

“A lot of people are talking about banks creating their own currencies,” Meade says. “I believe they will, but a country’s more likely to create a central digital asset.”

In fact, more than 100 countries — including the United States — are exploring or piloting CBDCs, according to the White House.

Utility Tokens

These work like gift cards. A gift card to, say, a Starbucks, has value only at a Starbucks. Increasingly speculators use utility tokens to raise funds for a project. For example, a casino builder might issue utility tokens for, say, 10 cents, to raise capital to build the casino. That token will be worth $1 when the casino opens.

“It’s like a gift card you buy at a discount,” he says. “I’m going to buy a $100 gift card to Maestro’s Steakhouse, but it’s got a value of $150. But I can only use it at Maestro’s Steakhouse.”

If the steakhouse closes — or the casino is never built — the gift card and utility token are basically worthless.

Bitcoin

Meade equates Bitcoin with gold. Like gold, a single Bitcoin carries a high value that is difficult to spend. A brick of gold might cost $500,000 but it’s impossible to break off a piece worth $250 and use it to buy something. However, you can buy smaller bits of Bitcoin and gold — they are divisible into smaller units. And the value rises and falls based on the market.

“Gold is a finite resource. The more gold you bring out of the ground, the more gold is in the supply. But getting gold out of the ground gets harder and harder. All the easy gold’s been found,” Meade says.

Similarly, the easy Bitcoin has been mined. So supply is limited and as more people want to buy it, the value goes up.

“The price of gold is irrelevant. The price of Bitcoin is irrelevant,” he says. The only value lies in whether a buyer believes its value will rise.

Crypto Tokens

These operate much like the stock market. In particular, they act like penny stocks. It costs very little to buy in, the investment is highly risky, but there’s a lot of potential upside.

“Most cryptocurrencies to me are glorified penny stocks,” Meade says. “You buy a token at 10 cents because you want it to go to $1, not because you want to use it to buy a cup of coffee.”

This is a market that is moved by public relations and big names.

Meade points to Apple co-founder Steve Wozniak’s WOZX token as an example. Wozniak’s company, Efforce, is a blockchain-based “energy efficiency market” for crowdfunding eco-friendly business projects. Investors drove the token to a $950 million market cap “in the first 13 minutes” of its listing.

Likewise, one social media missive from Tesla founder Elon Musk can drive the price of bitcoin and dogecoin soaring — or falling.

Tokenized Securities

This is the real estate equivalent of buying a share ownership of, say, the Empire State Building. The value might be tied to the appreciation in the value of the building, which would be realized only if and when the building is sold. Or it might include a dividend-like share of the rental income.

Non-Fungible Tokens or NFTs

These are probably the best known because they have been in the news so much. Who wasn’t jealous of Mike Winkelmann — the digital artist known as Beeple — when he sold an NFT of his work for $69 million? It was a big improvement from the $100 price tag for most of his works.

NFTs also are the most literal translation of crypto to more familiar assets. Buying an NFT is akin to investing in a piece of artwork or other collectible.

How Are Cryptocurrencies Valued?

Investors all over are hot to buy crypto for their personal portfolios on the bet that their value will rise. Sometimes all it takes is a tweet from Elon Musk or the endorsement of a Kardashian to make that happen.

Just as all stocks are not created equal — some list on the New York Stock Exchange while others trade over the counter — not all crypto is created equal. And, just as NYSE equities don’t trade on the NASDAQ, each cryptocurrency trades on just one crypto exchange.

Blockchain: The Power Behind Crypto

Blockchain technology is the platform that enables crypto. It uses cryptography, the mathematical and computational practice of encoding and decoding data to ensure secure communications.

Meade likens blockchain technology to the internet.

“There’s no such thing as an internet company,” he says. “The internet enabled people to do websites and ATMs and search engines and Netflix. The internet’s the enabler and this blockchain is the enabler.

“Blockchain enables digital assets, but the digital assets perform different functions and they operate on different blockchains and they’re not all compatible.”

For example, he says, if you’re running on an Ethereum cryptocurrency exchange and you send your money to a digital wallet on a Binance smart chain, the money is lost. It exists only in the Ethereum blockchain.

What Do You Need to Know about Crypto as a Business Leader?

Meade suggests that executives might want to buy cryptocurrency as a hedge against future volatility.

“I believe all public companies eventually will move 1 to 3 percent of their cash or bonds into Bitcoin as a qualified asset and a hedge,” he says. “If you’re sitting there going, ‘I don’t know about this Bitcoin thing,’ well, it’s doing 10, 15, 20, 30 percent returns. Even if you move 1 to 3 percent into Bitcoin to get those returns, it’s liquid enough you can get out when you need to.

“Basically, as a CEO, you have a risk portfolio. If you’re a public company and you’re sitting on stocks, that’s fine. If you’re sitting on cash or bonds, you’ve got to figure out where to allocate cash. You have a fiduciary responsibility to manage that cash.”

More importantly than investing in crypto, companies will need to understand blockchain technology, he says. That’s because it will become a more efficient way of managing the business for things such as invoicing.

The Potential Downsides of Crypto

Barron’s columnist Jack Hough put it this way: “It’s unfair to say that crypto is only for speculation. There’s also crime. Russian hackers made $400 million in crypto last year from ransomware attacks, and control three-quarters of the market, according to a research group called Chainalysis. Worldwide, $25 billion is held by ‘criminal whales’ or addresses with at least $1 million in crypto that can be traced to illicit sources.”

Still, digital assets, including cryptocurrencies, have exploded in value, to more than $3 trillion in November 2021, up from $14 billion just five years prior, the White House said when President Biden signed an Executive Order to address the risks and harness the potential benefits of digital assets and their underlying technology.

Scams are not the only reason to worry about a crypto future, Meade says. There’s also the really scary reality that the digital assets are programmable. That means they can be controlled by the issuer and their intermediaries.

“The problem with programmable money is if the government says, ‘We’re going to give you free health care, but we don’t want you smoking cigarettes anymore’ they can turn off your ability to buy cigarettes. You have no cash. It’s all digital and can’t be taken out of network. When there is no more paper money, you can’t leave the network and buy other things.”