Much has been written about board governance best practices. Much less information is available to help you figure out how to fix a board that isn’t delivering peak performance.

InterimExecs CEO Robert Jordan interviewed two experienced private equity investors, Eli Boufis and Steve Thompson, to talk about how to build a better board of directors.

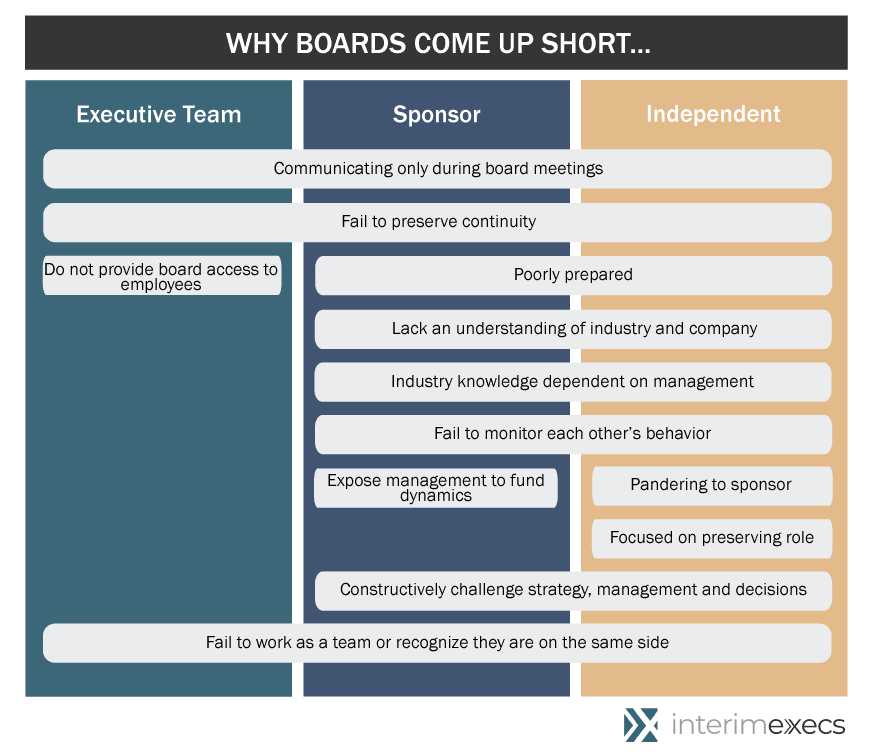

To start, they believe board composition should include independent directors — people who are employed neither by the company nor by the private equity fund — to ensure effective governance. But, they noted, there are six ways independent board members come up short on corporate governance.

Helping them improve on these six issues is the “low-hanging fruit” of improving board effectiveness, they say.

1. Lack of Access to the Team that Reports to the C-Suite

Eli Boufis says he sees his board role as “standing shoulder to shoulder with the executive team, seeking to help them overcome growth hurdles.”

To do that, “we need to have access to the people to appreciate what is top of mind for the team below the CEO and the C suite,” he says. It also helps them “understand that team’s depth to effectively execute on a growth plan.”

Steve Thompson also sees the skip interviews as a way to identify potential successors and help the board write a succession plan.

In one case, a series of skip interviews with the team below the C-suite and the people below them allowed Boufis to discover why the company was growing much more slowly than the investors had expected. The team lacked the maturity and capabilities to grow faster.

That resulted in a conversation with the CEO and the development of an organizational improvement plan to raise workers’ skills or swap them out.

The result: a 20 percent growth rate.

2. Board Members Lack Industry Knowledge

Board responsibilities should include investing the time required to understand the industry and the market. The investors’ onboarding process includes getting new board members to subscribe to industry journals, follow industry news, and attend industry conferences — all things the company pays for.

“We think that it provides a great deal of depth to the board conversation when the directors can speak about the industry and aren’t dependent on the management team for their market or industry observations, especially when asked to make difficult decisions about whether to enter or exit a market, where to invest growth capital,” Boufis says.

“We have also found it inadvertently to be an incredible resource to the management teams,” he says. “When Steve Thompson walks the floor of a trade show and his identity says Steve Thompson, the individual, and not Steve Thompson, the director, he can go into a booth and start conversations and get candid market intelligence that somebody may not have shared with him” as a director.

3. Directors Pandering to the Private Equity Investor

Board service involves sharing experience and wisdom with the management team, he says. Admittedly, that can be tough when the director knows that it isn’t his or her money on the table. So, the investors say, it’s incumbent upon the private equity sponsors to assure the directors it’s OK to voice contrarian opinions.

“If I wanted someone on the board who always told me that I’m right or smart, I would have hired my mother for the role,” Boufis says.

In one portfolio company, the independent director challenged them in front of the Chief Executive Officer and Chief Operating Officer. They responded calmly and walked him through their thought process.

“It defined the rules of the game where even what Eli said at the board was up for debate and challenge. And as a result of that, we’ve seen an incredible improvement in board productivity,” Boufis says.

“If I would have responded differently and said, ‘Damm it, I’m the investor; it’s my career that’s on the line here, not yours,”” things likely would have gone very differently.

And, he notes, it is the investor’s career. That’s “why you hired these intelligent people to challenge your decisions,” he says.

4. Board Members Do Not Monitor One Another

They erroneously believe that board management and monitoring board performance fall under the CEO’s job description. But, the investors note, it can be difficult for the CEO, even one who also serves as board chair, to challenge a board member.

A better governance model calls for board members to police themselves as equal stakeholders in the process. If, for example, a board member arrives in the boardroom obviously unprepared for the board meeting or treats the management team disrespectfully, it is incumbent upon fellow board members to comment upon it and offer advice for a better approach.

5. Communication Only Happens in Board Meetings

Boufis and Thompson say they have noticed a number of companies in which the directors thought their job was to show up at a board meeting, collect a paycheck, participate in decision-making at the meeting, and be done until the next board meeting.

“That doesn’t fulfill the function of a board being a trusted resource for the executive team, because so much happens in between board meetings,” Boufis says. “It’s our belief that the board should allow the CEO an opportunity to be reflective and strategic, and that doesn’t always happen in the board meeting.”

In one case, the director told the investors he did not reach out to the CEO because he believed the CEO was too busy and the director didn’t want to further tax his resources. So the investors talked with the CEO and asked him to reach out to the board member seeking advice as a way to open the lines of communication.

6. Lack of Continuity

This refers to the good governance process of building upon previous board meetings and staying focused on strategic planning priorities and how to achieve those objectives.

“You can’t identify a strategy and a path in one board meeting and come to the second board meeting a month or two later and recommend something completely different,” Boufis says. “It fatigues a management team.”

Read More:

- Private Company Governance: Why You Need a Strong Board of Directors

- 3 Things Companies Can Learn from How Private Equity Firms Work to Maximize Value

________

We can help you get more from your board of directors, whether you are a family-owned business, a nonprofit organization, or a private equity investor. The first step on that journey? To reach out to us for a confidential conversation.