“A world of no surprises.” That is the lofty goal of private equity investors Eli Boufis and Steve Thompson when they take on a new company. It involves open communication with the CEO – including reminders of how much money they can make if the acquisition succeeds – and a plan to build a better board of directors.

Building a better board of directors is a four-part process:

1. Outline Expectations

The first step is to go through a 45-page outline of their expectations of the board for communication, preparation, transparency, and openness.

They will tell the executive team and board members, “These are the decisions that require our discussion. This is how we should prepare for them.”

2. Analyze the Skills Gaps

In this step they work with the CEO to conduct a systematic analysis of the skill sets and competencies of each board member. Next, they compare that list against the skill sets they believe the organization needs based on where it is today and where it needs to be at exit.

That gap analysis “very quickly identifies for us the skill sets we need in the next independent director,” says Thompson. “We always share this analogy that if we had to have surgery, the first thing we would do is try to find the best surgeon. And we focus on having the best surgeon rather than having the best tools.”

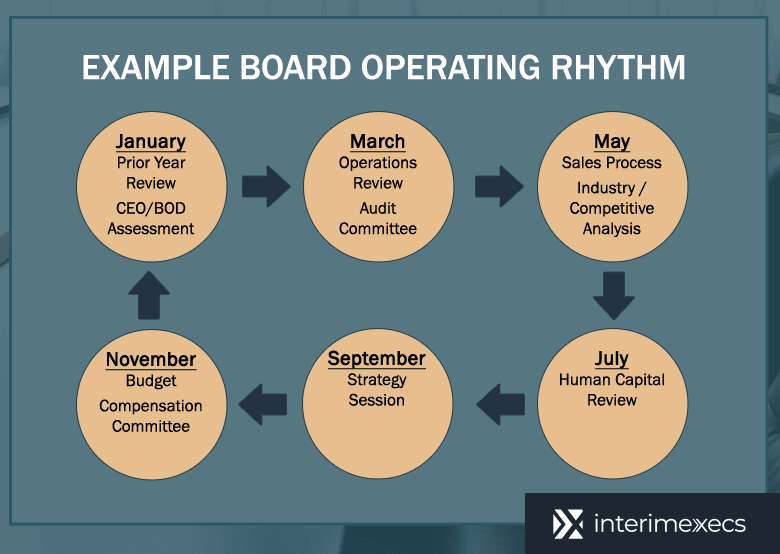

3. Set an Annual Operating Rhythm

Building a better board of directors requires a plan for ensuring that “every aspect of the business is discussed annually.”

Each board meeting starts with a review of the minutes of the last meeting, a financial review, sales forecast, and an analysis of the business and the marketplace.

Then there is a deep dive into one or two functional areas. January’s meeting, for example, is spent reviewing the prior year’s results and a self-assessment of the CEO and the board members.

Other meetings will focus on the audit, or industry competition. A deep dive into human capital lets the board anticipate positions that will need to be added based on anticipated growth. Finally, there is a strategy meeting to prepare for the budget and compensation for the following year.

“We appreciate that there are a number of incredibly important discussions that have to take place at the board level, and we make sure that nothing falls through the cracks, or something just happens because it’s top of mind,” Boufis says. “When you have this in place and the directors are all aware of it, they don’t think to say, ‘You know, at the next board meeting, we really need to discuss the team’s ability to execute the plan.’ We know we’re going to do that every July.”

4. Assess Performance Annually

Thompson says he’s always amazed by how few companies assess the CEO’s performance each year. And he notes, even fewer companies do an internal assessment of how the board is functioning.

The investors developed an annual board assessment that asks board members to assess their own performance, to assess how the board is functioning as a whole, and to assess the performance of the CEO.

On the self-assessment, they answer questions such as:

- What did they do well?

- What could they have done better?

- What are their goals personally for the next year and their goals for getting more involved in the business?

On the board assessment, they are asked:

- How did the board function as a whole?

- Was there openness and transparency?

- Was there healthy conflict?

- What are the examples of that?

- What could we have done better?

The board will assess the CEO against the performance metrics for the CEO and for the organization.

Getting the Help You Need

InterimExecs RED Team are experienced CEOs, CFOs, COOs and executive operators who understand how to work with boards and private equity investors. Call us at 847.849.2800 for a confidential conversation about how an interim or fractional executive can help you.

_______

Read more: