As the adage goes, “Growth solves many ills.” Growing companies create more buzz, have an easier time attracting capital and talent, and overall have more opportunities than those in decline or with stalled growth. The two primary sources of top-line growth in revenue are sales to new customers and generating sales growth for existing customers. Both are most easily improved with fresh sales initiatives.

Yin to the yang of optimization efforts, maximization focuses on growing total revenue, market share, units, gross sales margins, and customers. It also focuses on maximizing the opportunities to sell products or services in properly defined and highly aligned channels, a process commonly referred to as the value chain. The value chain includes all activities from pre-sales to customer service that directly impact the customer base.

How Interim Executives Fuel Top-Line Growth

Experienced interims build a great deal of unique knowledge by working with dozens of clients in small businesses, struggling organizations, and profitable companies. They have seen, in detail, different strategies for identifying operating efficiencies to improve a company’s revenue potential.

It would take most executives more than a lifetime to accumulate the knowledge interim executives bring. That results in innovative ideas, tools, and proven approaches to selling, marketing, branding, and positioning products and services, with many oriented towards leveraging sunk costs of product development to drive the highest net profit on add-on sales.

Interims start by examining sales plans, trends, and the performance of products and product lines. They analyze production and distribution models and their alignment with sales channels. And they study the sales capabilities of the company as well as its marketing prowess.

Then, interim executives build plans to spur innovation of sales tools and techniques.

Assessing a Company’s Top-Line Performance

In assessing the potential for revenue growth, interims first need to ensure that the operational capacity of the organization is matched to its demand-generation capabilities. Without that step, issues, errors, and costs will increase along with volume. Many retailers, for example, experience functional breakdowns during peak holiday sales days such as Black Friday and Cyber Monday when sales volume exceeds the capacity of people, processes, and systems.

The gap between that volume and the current sales volume represents the ideal revenue expansion opportunity. Maximizing revenues within operational limits also improves bottom-line figures because the infrastructure supporting higher volume is already in place.

Analyzing the Marketplace

Here companies can face a number of issues including declining market for its products, significantly increased competition, and opportunities lost by not keeping pace with dynamic and volatile markets.

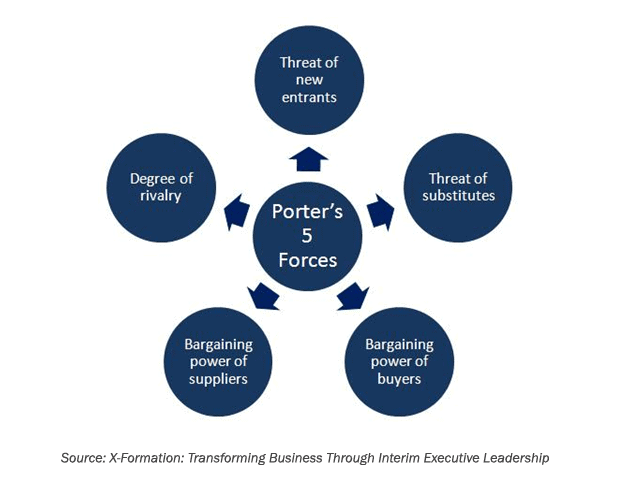

Interims with experience in creating sales and marketing excellence use several different techniques to analyze the current market to develop action plans that will maximize sales. Some of these techniques include:

- Market Research – Analyzing sales performance and opportunities with fresh eyes, interim executives can introduce operating efficiencies, new ways of assessing sales performance, and marketing campaigns to boost sales in defined markets.

- Competitive Analysis – Hard data showing where products and services stack up against those of major competitors provides several benefits to an organization. The first is clarity on meeting customer needs. The second is knowledge of strengths and weaknesses of competitors and their specific offerings, including product pricing, features, guarantees, bulk discounts, and the like. Finally, good competitive analysis gives an organization a clear view of where the competition is weak and strong.

- Product/Product Line Performance – Products and services require constant innovation to remain fresh and relevant, especially in fast-moving markets. Every product has to earn its spot in the lineup. Many companies produce and support new product lines without understanding the performance and profit margin of one item versus another. Others constantly add new products without retiring underperforming legacy items. Interims, with no emotional ties, can provide surprising data-based recommendations to their clients and paint a vivid picture of products that are working and those that are not.

Product Alignment

Once the highest-performing products are identified, it’s time to find ways to drive higher volumes of these items and decide what to do with low-margin products. Product alignment focuses on factors such as:

- Product/Product Line Definition – Product lines should have clearly established benefits that support good, better, and best pricing with powerful hooks into each successive price tier. Throughout this process, interims challenge their clients to honestly evaluate whether all products are earning their position in the catalog and delivering appropriate top-line sales.

- Pricing Analysis – Proper pricing drives customer enthusiasm. In assessing pricing, interim leaders typically start by looking at overall sales volumes, gross profit margins, and effective discounts by product and by customer to assess the relative health of all products and services. Understanding the competitive landscape, the interim executive will look for opportunities to improve gross revenue on existing sales volume and to sell items in new markets and new ways.

- Value-Added Services – Regardless of product or industry, value-added services that are highly aligned with the needs of the existing customer base represent the biggest opportunities for bottom-line growth. These transactions piggyback on the sale of other products and services and offer the opportunity for low-hanging additional revenue. Interims help organizations think about the full potential of a revenue stream, sometimes unlocking powerful add-on revenue.

- Bundles & Kits – The notion of bundling or kitting several items into a single purchasable unit, like value meals at quick service restaurants, exists in virtually all sales models. By bringing experiences in bundling learned at other clients, interims are able to introduce perception-changing ideas and approaches.

- Bulk Sales – Most people and companies like the notion of getting a “deal,” and multi-unit discounts deliver on this promise while also giving the seller the opportunities for reliable cash flow, less per-unit support, and higher net income for that product.

- Recurring Revenue – Recurring revenue is the Holy Grail of all sales models. It provides an incredible cash flow benefit to total sales. Some products are oriented to recurring revenue models (e.g. satellite radio) but, with leadership from interim executives experienced in recurring revenue models, many companies could augment current products or create new products that are maximized for recurring revenue.

- Channel Partners – Interims look to maximize all sales channels. Channel partners are one way to do that. Finding partners who come in contact with an ideal target market and whose products add context or value but do not compete is the way to create a virtual sales force that can dramatically increase reach and scale through indirect efforts.

Sales and Marketing Efficiency

With a focus on maximizing sales and marketing efforts, interims look at the people, processes, and systems of an organization to measure the result of individual cycles and events, striving for maximum sales dollars per cycle.

Interim CMOs analyze key metrics to determine brand strength, equity, and recognition, and the overall positioning of items in target markets. They assess the alignment of those markets to sales channels and the value of prospects, leads, and qualified leads versus the costs of conversion. They model and understand lifetime value (LTV) and fulcrums that can drive increased loyalty and maximize LTV, knowing that marketing costs and results require deeper insights than simply cost-per-conversion.

In all of these activities, the interim is using proven approaches to lead and teach the organization how to segment its sales activities and pipeline and measure the effectiveness of key activities. This data provide insights into not only the health of the pipeline but also the potency of the overall sales strategy, tools, and processes.

Customer Experience and Retention

The most potent sales strategies can be undermined by poor customer satisfaction and retention. No matter how effectively companies acquire new customers, if they have significant turnover in their customer base, revenues will suffer.

To assess customer health and satisfaction, interim execuives will typically examine metrics from customer satisfaction surveys, the number of customer requests and complaints, feedback from customer advisory groups, and transactional data such as product return rates, order turn-around time, length of call center calls, length of sales cycle, average ticket size, and customer recency/frequency.

Next, experienced interim executives know to look at customer points of contact at all levels of the organization, from the user to the decision-maker. Without regular attention, those decision-makers may start looking for new suppliers.

To serve all levels of the customer base, interims will ensure that customers always know who to contact when there is a problem. It’s easy to lose track of this, especially at companies in cost-cutting mode that chop operating costs by focusing on administrative costs and budgets. That can easily translate into neglected customers.

The takeaway from improved customer satisfaction: increased sales, reduced operating expenses, and improvements in the company’s income statement and overall financial performance,

Plan Value Chain Improvements

As insights emerge during the assessment phase, opportunities become clear. Those range from quick hits to long-term transformations with varying levels of cost, complexity, and payback.

In planning the ensuing changes, interims look for the highest return on the lowest investments in time, people, money, and assets. To provide some degree of improvement quickly, vs. realizing the full benefit later, interims will look for Minimally Viable Products (MVPs), which represent a quick manifestation of value. And they will align the changes with other major initiatives across the business operations.

Maximization efforts have both an internal plan and an external, or customer-facing, communications plan. Internal plans are designed to prepare the organization for change, clearly communicating impacts to sales, commission plans, pricing, customer service, and other core processes. External plans revolve around the anticipated marketplace, branding, or positioning impacts.

Execute Value Chain Innovation

With a clear plan in place, the focus turns to executing short and longer-term plans, each segmented by phase and with clearly stated goals.

Sometimes maximizing sales and revenues amounts to several small initiatives that need to be accomplished. But sometimes change requires a major transformation of the company, culture, or overall approach to the market. These could include, transitioning to a customer-centric culture, entering new markets or leaving an existing one, repositioning products and pricing, moving to or from direct sales and partnership models, and the like.

Interims are effective at helping companies implement and execute these types of transformations with confidence due to their experience in leading large-scale transformations.

In addition, interims tend to be great teachers, taking time to teach those around them new ways of approaching and solving problems. They are also great leaders, not only managing the team in the execution of the plan but also in adding hard data to measure the results delivered.

Contact InterimExecs to learn more about how InterimExecs RED Team – an elite group of CEOs, CFOs, CIOs, and COOs – can help your company maximize results through a strong strategic planning process and better execution of your strategic plan.

———————————

This article draws on the chapter “The Interim Executive Approach” featured in X-Formation: Transforming Business Through Interim Executive Leadership, a guide to interim management written by several veteran executives on InterimExecs RED Team.

The needs of a typical organization can be broken down into four major areas, each representing an execution discipline interims practice to assess needs and take action. See the other three parts of the series: Optimize, Strategize, and Organize