Private equity funds are entering a new phase that requires new tactics to be successful against many alternative sources of funds. With a vast reservoir of dry powder – $1.5 trillion waiting to be deployed – PE funds seeking the whip hand will build and pivot while the economy is reinventing and reviving in 2021 and 2022. But what worked in the past won’t work in the future. Moving forward, adding value will require more attention to management fit for the purpose of rapidly transforming portfolio companies.

“Every good private equity professional will tell you that the most important factor behind a successful investment is the management team,” said Eric Jones, a partner and member of the corporate and private equity groups at Detroit law firm Honigman LLP. Jones was a speaker at the University of Michigan Private Equity Conference held virtually in September 2020 and attended by InterimExecs. “You can have even market share, but without a very strong management team, it’s not going to be sustained. The business isn’t going to grow and the investment piece isn’t going to be realized,” he said.

Private Equity’s Operationally Intensive Approach

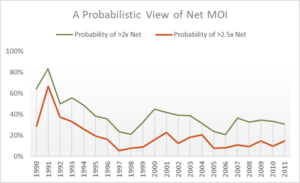

Private equity has come a long way over the past 40 years. The industry emerged in 1980 with just a handful of firms that increasingly came to specialize in junk bonds and leveraged buyouts of U.S. companies. Four decades later, PE is now a $4 trillion global sector with fund sizes larger than the GDP of some countries and rates of return that rival or sometimes handily beat the S&P 500.

With that growth has come massive competition. Alejandro Castro, President and CEO of Authentico Foods, took over a food company started by his grandparents and grew it to the point where it attracted private equity firms. He told the Michigan Private Equity Conference that more than two dozen PE funds were interested. A bidding war ensued, and he eventually whittled the candidates down to six.

After Kirtland Capital Partners (KCP) won the bid and took over the business in 2019, the opportunity emerged to acquire a second food company and merge them under the banner of Authentico Foods. At the time, they didn’t have the right internal team, so the fund helped build out the management team with the skillsets needed to expand Authentico Foods well into the future.

The right team has become more and more important for PE-led portfolio companies where higher purchase prices mean increasing pressure to move way beyond incremental improvements in the business. Panelist Evan Kramer, an experienced PE and VC-backed CEO, noted that the values of companies are almost creating hyper value in bidding processes. PE funds are coming in with more leverage than they would 10-15 years ago, so strong leadership is needed to manage and de-risk that leverage. How to grow cashflow and EBIDTA, accretive add-ons, and ways to streamline the business are on the to-do list of most private equity backed CEOs.

In addition, the pressure for deal flow has led many funds to cross into new industries and sectors. Kramer says that PE funds that focus on a particular category may become more opportunistic and generalist based on the opportunities available. For example, a fund might invest in a food group even though they have never invested in that area before. “It’s about finding the best deal, not necessarily the right target,” said Kramer.

Jodi Hochberger of Goldman Sachs told conference attendees that in the current environment, mid-market firms may derive an advantage from their ability to use a “hands-on” approach to drive portfolio value creation. “A lot of the middle market firms have very strong operational capabilities and one might argue in a more volatile environment that can be very additive when it comes to cutting costs, growing revenues, expanding internationally, tucking in acquisitions, etc.” said Hochberger. “I think many investors, including on the institutional side, are very attracted to the more operationally intensive approach many of the middle market firms pursue.”

Buy and Transform

Dave Ulrich, professor at the University of Michigan’s Ross School of Business argues that private equity is in the third phase of its evolution, something that he calls the “buy and transform” phase.

In phase one, writes Ulrich in the Harvard Business Review, PE investors look for a “fixer-upper” company that can be bought at a discount, refurbished, and resold for a profit. In phase two, PE firms loosely managed the acquired company before eventually selling it. But in phase three, PE firms don’t just manage the acquired company—they transform it.

This shift means that PE’s approach to talent and leadership must also change, says Ulrich. With a buy and transform model, “financial discipline is not an event, but a pattern; strategic clarity is not a direction, but a commitment; operational excellence is not a tool, but a mindset.”

Ulrich stresses that in phase three of private equity, traditional data gathering and number-crunching capabilities are not enough to ensure a competitive advantage. More than half of value creation today can be attributed to intangibles such as strategic clarity, brand, talent, and leadership capital.

In managing PE-owned companies, Evan Kramer, who currently is CEO of White Globe, said being able to provide a playbook from company to company can provide significant value. There are three things Kramer drives out of the gate:

1) Unlock value from data. When he comes into a business, especially one that is founder-owned, there’s typically a low level of infrastructure and sophistication. Having good data makes it possible to uncover a lot of valuable insights.

2) Get the team to move faster. PE rewards a fail-fast and learn-quickly culture. Whether using automation or human processes, portfolio companies must have agile workflows and move quickly to grow.

3) Spirit of innovation. The status quo is the enemy of transformation. You have to lay the groundwork for innovation before unlocking value. Staying ahead of the game is something that the whole company has to buy into. Leaders must foster a culture that drives innovation.

The High Cost of High Executive Turnover

When KCP acquired Authentico Foods, they expressed confidence that they had the right man in Alex to lead the company. He had already built a strong business with an excellent reputation and developed a business plan to integrate and grow the two businesses by combining their resources and using economies of scale.

But the alignment between Authentico and KCP may be surprisingly uncommon in the broader PE space. While private equity understands the importance of strong leaders like Alex, they often struggle to identify it. More often than not, this lack of vision costs them.

The results of a private equity survey performed jointly by Vardis and AlixPartners found that stability at the top of a company has a huge impact on its overall performance. Respondents reported that 73 percent of CEOs are likely to be replaced during the investment lifecycle, including 58 percent during the first two years. Moreover, C-suite turnover is disruptive and costly, leading to a worse rate of return nearly half the time and a longer hold time in more than 80 percent of cases.

Misalignment between private equity and CEOs is a major reason for high turnover. The most common reasons cited for replacing a CEO were lack of fit with the new strategic direction and failure to deliver results.

These findings suggest the need for more thorough pre-deal screening and market referencing to reveal misalignment. Yet despite the need for better leadership planning, only 39 percent of private equity respondents said they changed their approach. And the problem isn’t limited to CEOs. Most respondents said they didn’t have suitable successors identified for the COO or CFO roles, either.

Part of the challenge for PE executives is creating a comprehensive portrait of the leadership they’re bringing in. For example, the survey indicated that the traits PE firms value most highly in a CEO — leadership skills and strategic thinking — were among the most difficult competencies to assess.

InterimExecs developed a different approach to PE executive search. We spent ten years screening over 6,000 executives, ranking and scoring each based on their track record, mindset, and leadership approach. We chose only the best of the best to form InterimExecs Rapid Executive Deployment (RED) Team, a go-to cadre of top operating executives across operations, finance, technology, marketing, and sales.

When an investor or management team requests leadership, we can act fast to make the right match. InterimExecs RED Team is an elite group of CEOs, CFOs, COOs, and CIOs who help organizations through turnaround, growth (merger, acquisitions, ERP/CRM implementation, process improvement), or absence of leadership. Request a call to discuss RED Team support for your portfolio company or learn more about how InterimExecs RED Team serves as an executive bench for private equity at: www.interimexecs.com/private-equity or call +1 (847) 849-2800.

More Resources:

*Private Equity Investors Tap Interim Executives to Transform Portfolio Companies

*The 6 Biggest Mistakes Companies Make