Even before the pandemic forced businesses to be more nimble and forward-thinking than ever before, the need for interim executives had been growing. In 2020, we asked 600+ execs to shed light on interim roles, a comprehensive survey that covered the who, what and why behind the growth of this category. And now as the world is finally defeating COVID-19, businesses are continuing to adapt and re-strategize with a new set of challenges, only amplifying the need for experienced, “make it happen” interim executives even more.

To better understand how the current marketplace is dictating the need, we conducted a follow-up survey, asking 125 executives to answer the same question: “What trends do you anticipate having the greatest effect on the interim specialty in the year ahead?”

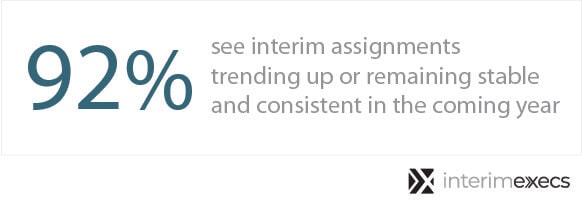

Across both surveys, the conclusion was clear: interim executives are needed now more than ever. 71% of respondents see opportunities for interim management trending up and another 21% seeing they will remain stable throughout the coming year. Here, we break down the five reasons why more organizations are drawing on interim executive leadership: